One of the greatest risks of a leaked SSN is that scammers can use it to take out loans or open financial accounts in your name. A credit freeze prevents anyone from accessing your credit file — which means that scammers won’t be able to ruin your credit score. Regularly reviewing your financial statements, like bank accounts and credit cards, is essential to detect unauthorized activity. Look for unfamiliar transactions, new accounts, or changes to existing ones.

It’s especially important to complete fraud and police reports if you are going to dispute fraudulent charges; otherwise, there’s no proof of your being a victim. The bad news is that once your SSN has been leaked to the Dark Web, it’s virtually impossible for you to remove it. The best thing you can do is to proactively lock down your identity and accounts and be prepared for the worst.

How To Monitor Your Credit Reports

CreditWise lets you monitor your FICO Score 8 and get alerts when important changes are made to your TransUnion and Experian credit reports. You’re eligible to enroll in CreditWise if you’re an adult residing in the US and have a Social Security number and credit report of file with TransUnion. Illicit dark web marketplaces and forums ooze stolen and compromised PII, including SSNs sold to the highest bidders. The best way to find out if your SSN has been leaked online is to check if your data was part of a data breach. Additionally, you may have received a data notification letter from a breached company, which should specify what type of information was involved. In its statement, NPD also urged people to put free fraud alerts on their accounts, which “tells creditors to contact you before they open any new accounts or change your existing accounts,” it said.

Can You Change Your SSN If It Was Leaked?

Some of the offers on this page may not be available through our website. Your SSN is a crucial piece of personal information that can be used to commit fraud and identity theft. Acting quickly and decisively to protect your identity and financial well-being is essential in this situation. If you can’t remove your Social Security number, redirect your efforts to deleting other compromised information. Remember, if your SSN has been breached, so has other personal information.

Step 4: Consider A Credit Freeze

Gareth Neumann is a retired Baby Boomer in his early sixties (no one’s allowed to know his actual age!). He still fondly remembers his first job as a store clerk at the tender age of 12, and it was non-stop work since then. Now he’s decided that he’s worked enough to last two lifetimes and finally retired in 2014. When two-factor authentication is enabled, a code is required in addition to your username and password to log in.

Lock Your SIM With Your Cell Phone Provider

Every year, you will receive a new IP PIN to ensure the utmost protection of your SSN and taxes. Create or log in to your mySocialSecurity account to see if there has been any suspicious activity. Your mySocialSecurity account will show your benefits (if you have applied for them) and other helpful information. If you are not receiving any benefits, your mySocialSecurity account will show proof of this. To monitor your account, just sign in and review your statements if you have any.

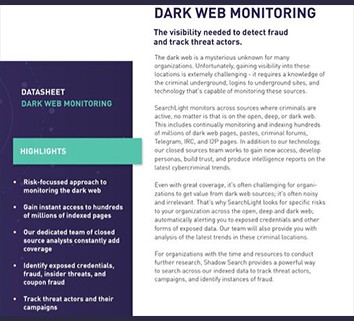

When your SSN has been found on the dark web, you should immediately change all your passwords to prevent a cybercriminal from accessing any more of your private information. You can quickly change all your passwords by using a password manager, such as Keeper, which can generate new, strong passwords for each of your accounts. The dark web refers to a segment of the internet that is not indexed by traditional search engines like Google.

What Can Scammers Do With Your Social Security Number?

That hacker claimed the stolen files include 2.7 billion records, with each listing a person’s full name, address, date of birth, Social Security number and phone number, Bleeping Computer said. From Social Security numbers to bank logins and medical records, cybercriminals buy and sell stolen data every day. Following breaches at Capital One, Equifax and a slew of other financial and healthcare organizations, there’s little doubt that your social security number has been compromised, say cybersecurity experts. Mine, too, as well as those of our spouses, neighbors, friends and colleagues. Certain cyber groups have set up websites to enable individuals to search to see if their personal data was affected by the breach, Lee said.

Impel Global: Transforming Financial Messaging And Payments Through Blockchain Precision

That strategy is reason enough to protect your passwords and use passkeys whenever possible. Regularly monitor your credit reports and financial statements for any suspicious activity. If you’re concerned that your data’s been being used against you, it’s time to use an identity theft protection and credit monitoring service to protect yourself. Enable two-factor authentication (2FA) for sensitive accounts, use unique passwords, and update them regularly. This adds an extra layer of protection against hackers and data breaches. Beyond credit protection, immediately change passwords for all online accounts, especially financial, email, and social media accounts.

- Freezing your credit effectively blocks anyone from applying for new credit in your name, and it stays in place until you lift it.

- The dark web refers to a segment of the internet that is not indexed by traditional search engines like Google.

- If you see anything suspicious, contact your bank or credit card company right away.

- This will require anyone trying to sign in to your accounts to have not only your username and password but also an additional form of authentication.

- “The most important thing you can do is put a freeze on your credit,” says Chapple.

As you freeze your credit, be extra vigilant that you are on the legitimate websites of the credit bureaus, and not look-alike sites aimed at stealing your personal information. You may have never heard of National Public Data, yet your personal information may have been compromised in the company’s recent massive data breach. If your SSN was leaked and is potentially being used for identity theft, you can apply to the Social Security Administration to change it.

Whether you freeze or lock your credit, it’s also a good idea to place fraud alerts on your credit reports with the major credit bureaus. This will add another layer of security as creditors will have to take extra steps to verify it’s really you before extending any credit. Your Social Security Number is a key to many aspects of your life—financial, medical, and personal. The discovery of your SSN on the Dark Web can be alarming and can open the door to various forms of identity theft and fraud. In recent times, data breaches have become more common, leaking sensitive information like SSNs onto parts of the internet where criminals can easily access and misuse them. For instance, residents in Oakland found their SSNs exposed following a city-wide data breach, underscoring the reality and closeness of this threat.

By implementing these preventive measures, you can significantly reduce the risk of your SSN and other personal information being compromised. While it’s impossible to eliminate the threat of cybercrime entirely, taking these steps will make it much harder for cybercriminals to access and misuse your data. Formally reporting the SSN compromise is an important step in the recovery process. The Federal Trade Commission (FTC) offers a centralized resource at IdentityTheft.gov to file an identity theft report. This online portal guides you through the process, asking for details and providing a personalized recovery plan.

This is the strongest way to protect the sensitive data in your credit reports and, as of last September, the process is completely free. Additionally, you should change all your passwords, particularly if you have repeated passwords among multiple websites. Ideally, you should enable multi-factor authentication for personal websites to help keep your financial data secure.